NAFTA 2.0 doesn't convince Canada

The renegotiation of NAFTA trade deal has left Canada dissatisfied with the current form of NAFTA 2.0 agreement signed between the US and Mexico. With a deadline set on September 30, Canada has now 4 options to proceed further, as Meat and Livestock Australia analysts point out:

- Firstly, withdraw from current NAFTA and be left with no agreement;

- Secondly, withdraw from current NAFTA and negotiate separate bilateral agreements with the US and/or Mexico;

- Thirdly, withdraw from current NAFTA and re-ignite the previous US-Canada FTA negotiated in 1987 (which formed the template for current NAFTA);

- Or lastly, join NAFTA 2.0 now or at some time in the future (within the next six months would avoid trade disruption).

If Canada refuses to join the NAFTA 2.0, that equals a redistribution of 130,000-tonne swt net beef from the US market to other parts of the world. In that case, Canada, despite the fact that is not a key industry player, could easily compete against the US, Australia and New Zealand in some important markets around the world.

"Canada is not expected to export significant volumes, it is able to compete in premium markets where Australia operates. In addition, some cuts it has been exporting to the US – namely, chuck, brisket and loin cuts – are well suited to North Asian cuisine.

However, a lack of preferential access will restrict growth in key markets. In Japan, Canada competes with the US and New Zealand within the quarterly chilled and frozen non-EPA safeguards – the frozen safeguard was triggered last year, causing tariffs to temporarily snapback to 50%, and has remained highly subscribed since. Pending ratification from remembers, Canada, along with Australia, will have improved access to Japan under CPTPP (beef tariffs of 38.5% will reduce to 9% over 15 years, and an annual global safeguard will increase incrementally from 590,000 tonnes swt). Meanwhile, the supply of HGP-free fed cattle in Canada will dictate future growth in exports to China and the EU.", shows MLA analysis.

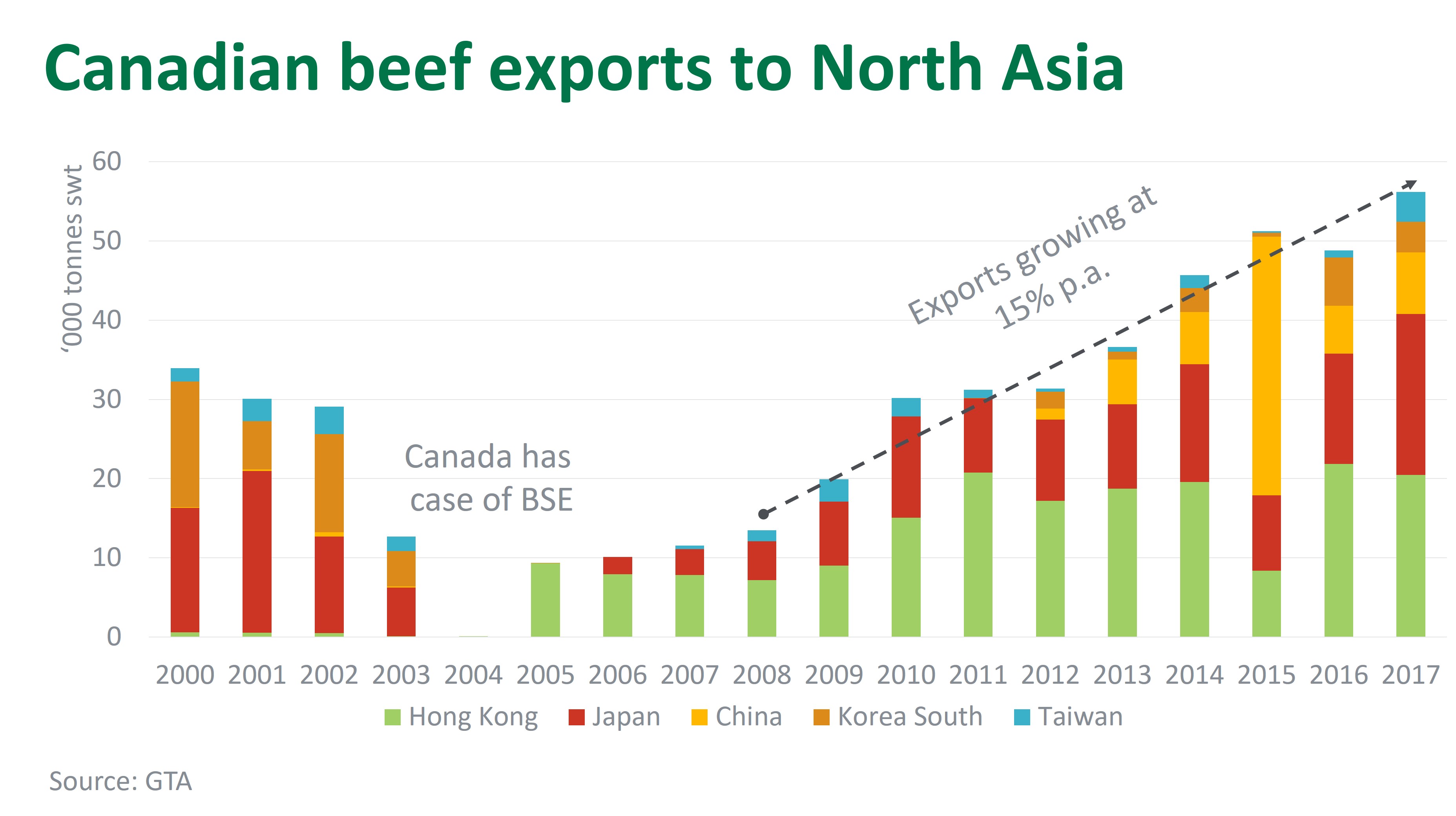

North Asian states have already seen an increase in Canadian beef exports and the growth in these markets was steady in the last decade. "In the year ending June, Canada exported 21,800 tonnes swt to Japan, up 27% year-on-year and the highest levels since BSE, while shipments to Hong Kong were steady, at 21,700 tonnes swt. However, Canadian exports to China, at 6,400 tonnes swt, remain modest, as do shipments to Korea (3,700 tonnes swt) and Taiwan (3,500 tonnes swt).

While the market mix has fluctuated from year-to-year, Canadian beef exports to North Asia have recorded a solid 15% compound annual growth rate of the last decade, surpassing pre-BSE levels.", mentions the document.

At this moment, the US has been a net importer (on a volume basis) of North American beef for the last six years. In fact, the US has maintained a beef deficit with Canada since 1992 and developed another one with Mexico for the last three years.

The North American beef integration system developed under NAFTA trade deal is going like this: "A steer may be raised in Canada, fed and slaughtered in the US with Mexican labour, and consumed across all three markets. In 2017, the US imported 253,000 tonnes swt of beef from Canada and 210,000 tonnes swt from Mexico, while only exporting 82,000 tonnes swt and 133,000 tonnes swt to either country, respectively. If barriers are raised, this net beef trade to the US may need to find new markets", according to MLA.

Even so, that problem still has 6 months to become real, until Canada can withdraw from NAFTA, but, considering the current turmoils on global trade, an event like that can easily add a certain amount of uncertainty to the future development in the global meat market.

JBS has already invested more than R$35 million in cattle tracking and supporting small producers...

The US was the largest market for the month with exports worth $327 million, down five per cent b...

While the sheepmeat market experiences record prices, the Australian wool market is less robust. ...